36+ Irs Penalties Calculator

Web Estimate your federal income tax withholding. Web Generally most taxpayers will avoid this penalty if they either owe less than 1000 in tax after subtracting their withholding and refundable credits or if they paid.

26 Accountant Resume Templates Pdf Doc

How much can an early withdrawal cost.

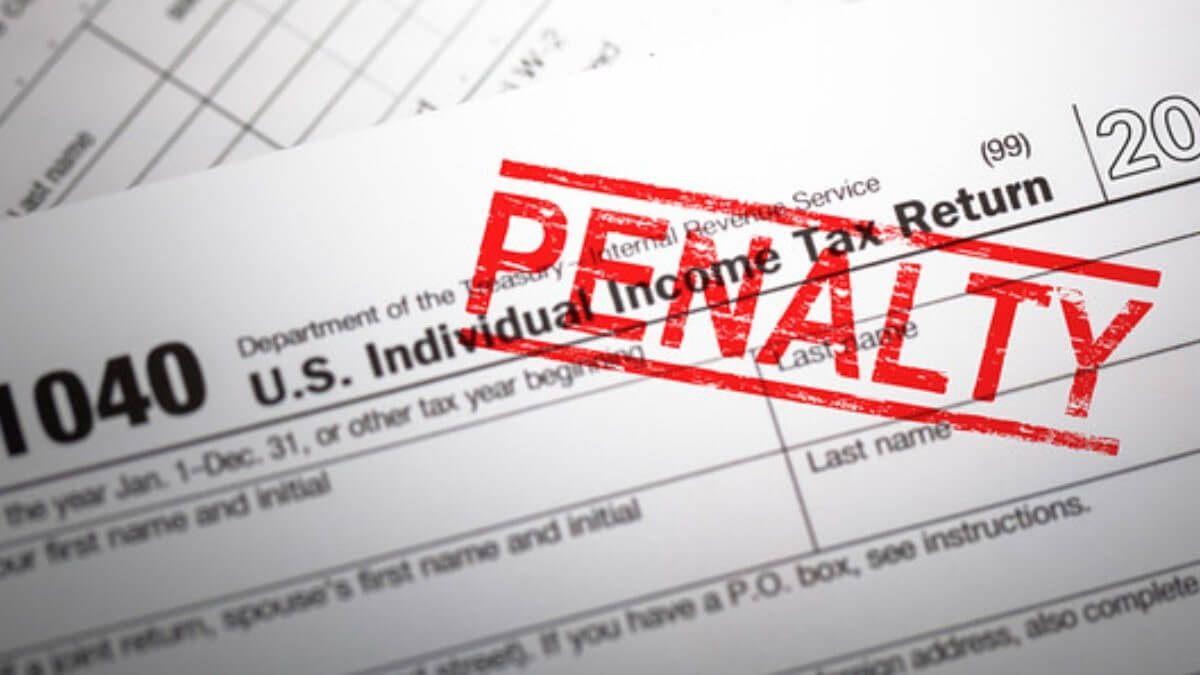

. Web The total penalties for filing taxes late is usually 5 of the tax owed for each month or part of a month that your return is late up to five months 25. Understand the different types of penalties what you need to do if you get a. Web We charge some penalties every month until you pay the full amount you owe.

Web The only exceptions apply to a small number of situations that the IRS exempts from the penalty tax which is 10. The penalties can be assessed due to both late-filing and paying. If the delay in filing tax return is over 60 days late the.

See how your refund take-home pay or tax due are affected by withholding amount. IRS Interest Rates Table. In order to use our free online IRS Interest Calculator.

Web Our free user-friendly income tax calculator will show you how much you owe or how big your refund will be. Trial calculations for tax after credits under. Calculate Dinhs net tax payable.

Calculate the late deposit penalty and. See If You Qualify For a Fresh Start Today. Ad Stop IRS Collections and Protect Your Wages.

Web Federal Income Tax Calculator. Web This is a penalty of 05 percent per month at a maximum of 25 percent after 50 months. Connect With Top-Rated Tax Experts Who Will Negotiate on Your Behalf.

Web The safe harbor method allows you to avoid an underpayment penalty if. Web The maximum total penalty for both failures is 475 225 late filing and 25 late payment of the tax. Web 1 Tax Extension 2 Types of IRS Penalties 3 How IRS Penalties Are Calculated Tax Extension Unsurprisingly the best option is to always file your tax return.

Web Calculate Form 2210. You owe less than 1000 in tax after subtracting your withholding and refundable credits or. Web To payoff the IRS by the payment date of the amount required to be paid is.

The Failure to Pay penalty applies if you. Web June 21 2019 by Tax Relief Center Fees and penalties can eat up your savings so knowing and using an IRS penalty calculator can save you time effort and money. If your return is over 60 days.

Web Transcribed Image TextDinh has derived taxable income of 36 200 for the 2023 income year. Ad Prepare for tax season with the interest calculation tool relied upon by the IRS. Well even estimate your withholding.

Easily handle IRSState interest penalty Notices and FIN 48 accruals per Section 6621. Web The IRS Penalty Calculator will help you find out how much you will pay in taxes added with penalties. Web The penalty is typically assessed at a rate of 5 per month up to 25 of the unpaid tax when a federal income tax return is filed late.

Web 40 rows IRS Interest Calculator. Web How We Calculate the Penalty In cases of negligence or disregard of the rules or regulations the Accuracy-Related Penalty is 20 of the portion of the. Tax Return and Refund Estimator 2023-2024 Estimate how much youll owe in federal income taxes for tax year 2023 using your income.

Web If you owe more than 1000 when you calculate your taxes you could be subject to an underpayment of estimated tax penalty. He is not subject to the Medicare Levy. This relief applies to forms.

This penalty may be adjusted depending on whether you are under a tax. To avoid this you should make. The underpayment of estimated tax penalty calculator prepares and prints Form 2210.

Web Calculate pay or remove the Failure to Pay Penalty when you dont pay the tax you report on your return by the due date.

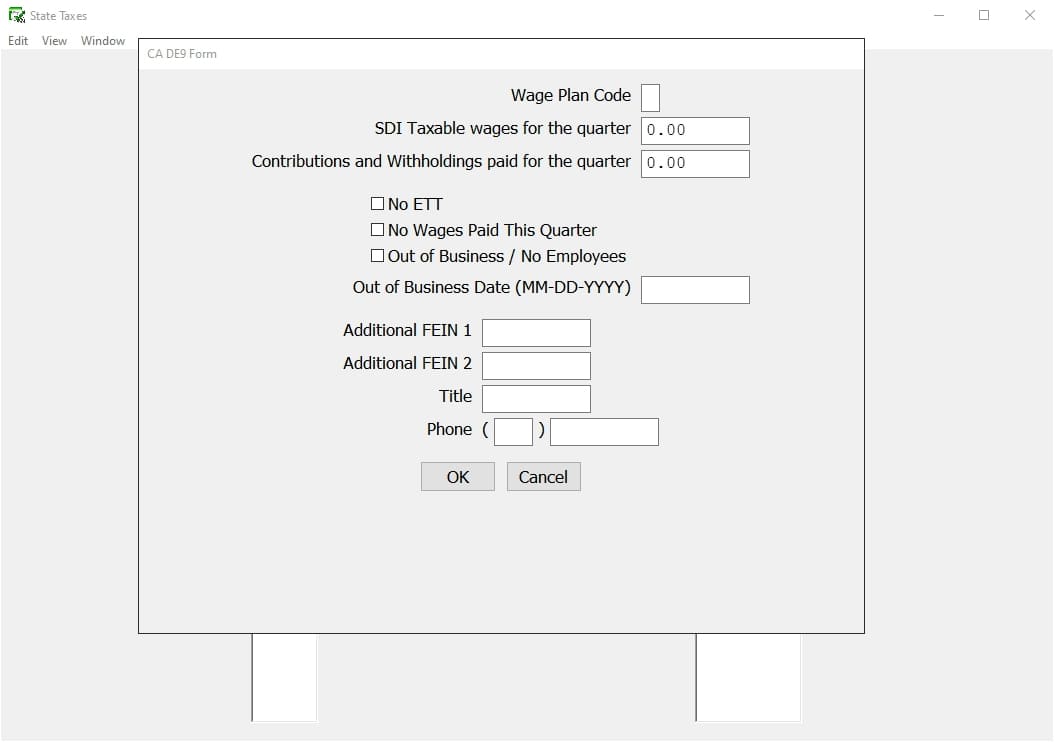

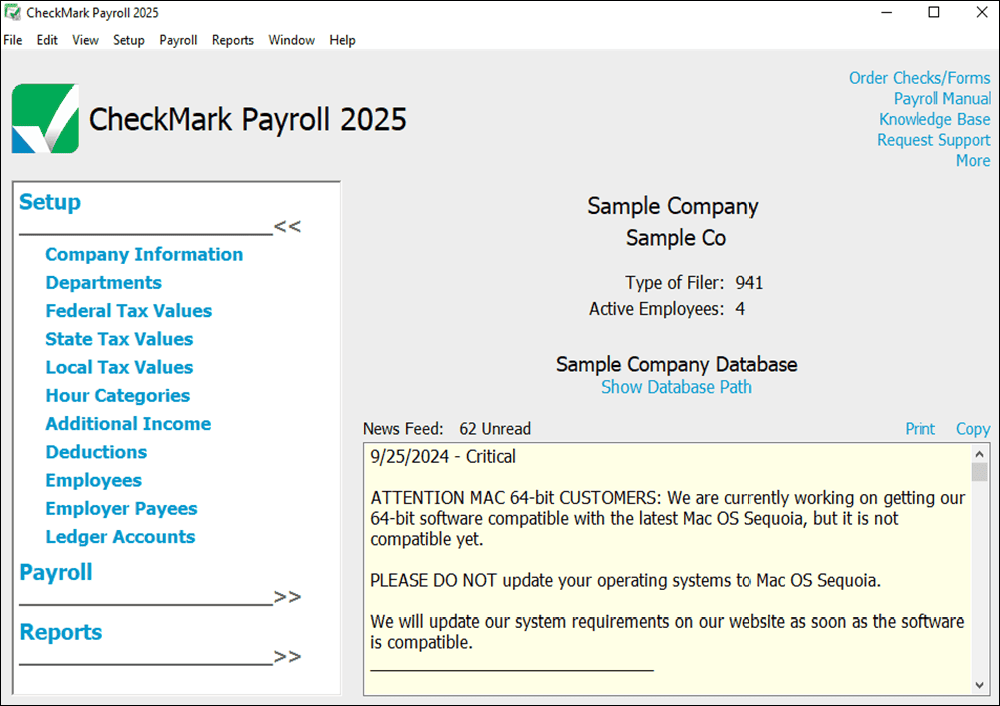

Best Payroll Software For Small Business Checkmark Payroll

Irs Penalizes More Earners For Mistakes Underpayment In Estimated Tax Filings

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Penalties For Failure To File Form 990 990 Ez 990 Pf Tax Returns

Nri Income Tax Help Center Eztax

Irs Penalty Calculator 2023 Irs

Indian Jewelry Supply Materials 4 Pdf Cheque American Express

Calculator For Irs Penalty And Interest

Online Payroll For Small Business Patriot Software Online Payroll

20 1 3 Estimated Tax Penalties Internal Revenue Service

Cra Penalties Interest Calculator Tax Topics Protaxcommunity Com

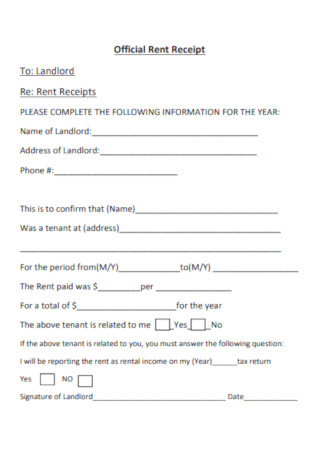

36 Sample Official Receipt Templates In Pdf Ms Word Google Docs Google Sheets Excel Apple Numbers Apple Pages

10 K

Tax Relief Services Irs Quicktip Taxtip Series Irs Frequently Asked Questions I Owe The Irs This Year But Can T Pay Still File One Option Is A Short Term Extension Up

Irs Interest And Penalty Calculator Income Tax Youtube

Easiest Irs Interest Calculator 2022 2023

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros